THE PROJECT

Designing a mobile banking app from the ground up

At Mobiquity in Amsterdam, I worked on the mobile banking app of KIB (Kuwait International Bank), focusing on the core financial interactions where system complexity meets everyday user behaviour. The objective was to design a comprehensive payment ecosystem for the mobile application, translating complex banking requirements into a clear, functional, and scalable mobile experience.

The work covered payments, transfers, credit card management, and foundational design patterns, with a consistent focus on clarity, trust, and usability within a regulated financial environment.

ROLE & RESPONSIBILITY

Product Designer + Squad Lead

As one of the first designers in the team, I was responsible for establishing the foundational design processes and tooling needed to support a growing product. As the design team expanded from a solo setup to a team of six within a few months, I transitioned into the role of Design Lead for the Payments Squad.

In this role, I designed and oversaw the end-to-end design of all payment functionalities while ensuring consistency across the evolving design system and collaborative workflows. This included aligning product, engineering, and design efforts around shared interaction patterns and scalable UI foundations.

INTERACTION MODEL

Creating a simplified payment flow for all money transfers

A central initiative that I proposed and developed was restructuring how the app handled money transfers. Domestic, international, internal, and own-account transfers previously existed as separate features with different entry points and form structures. This mirrored internal banking logic rather than how users think about sending money.

I redesigned this into a single unified transfer experience. Instead of choosing a transfer type, users begin with what they naturally know — the amount and the recipient. The system interprets context in the background and adapts automatically, turning multiple banking processes into one coherent interaction model. This reduced decision friction and created a scalable foundation for future payment features.

CORE PAYMENT FLOW

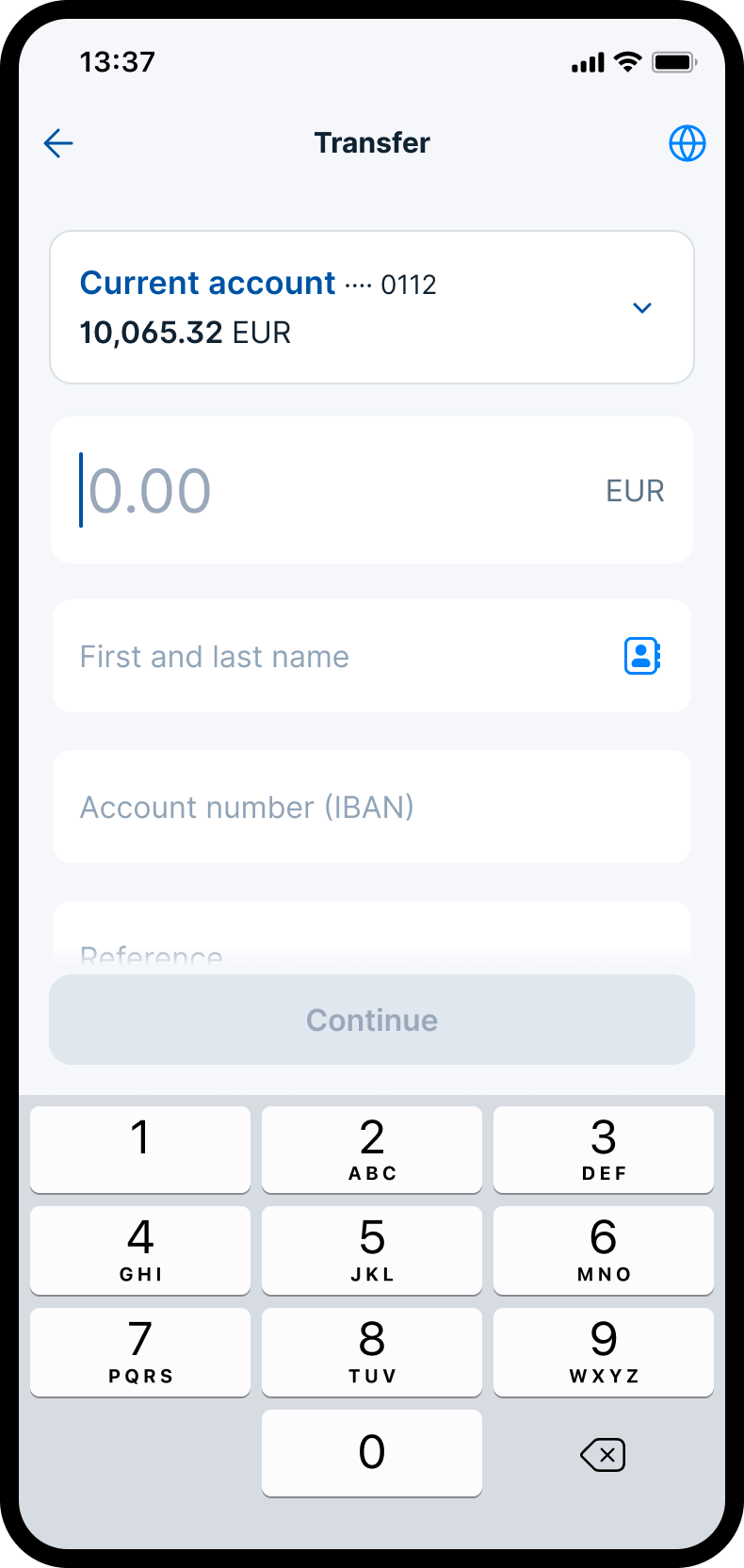

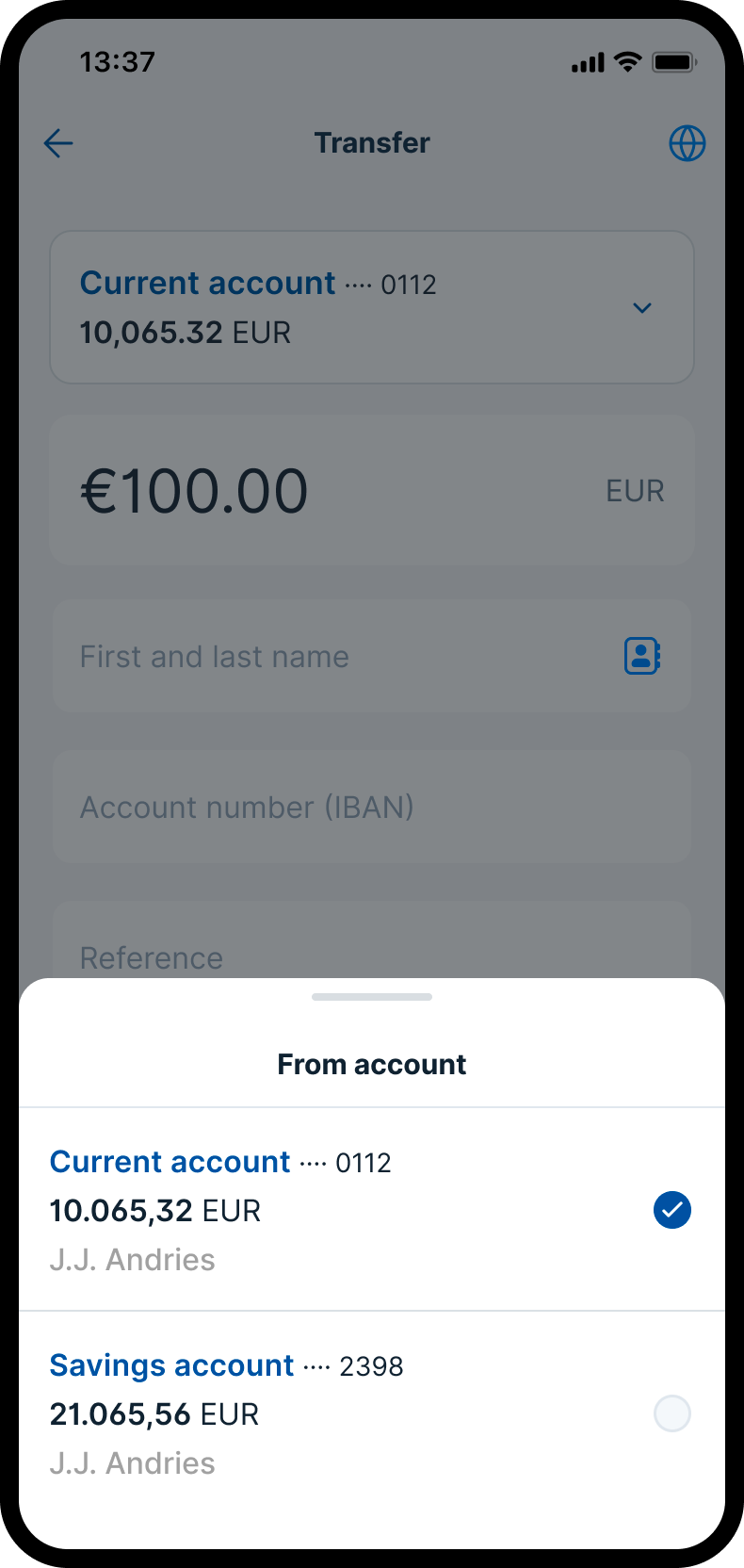

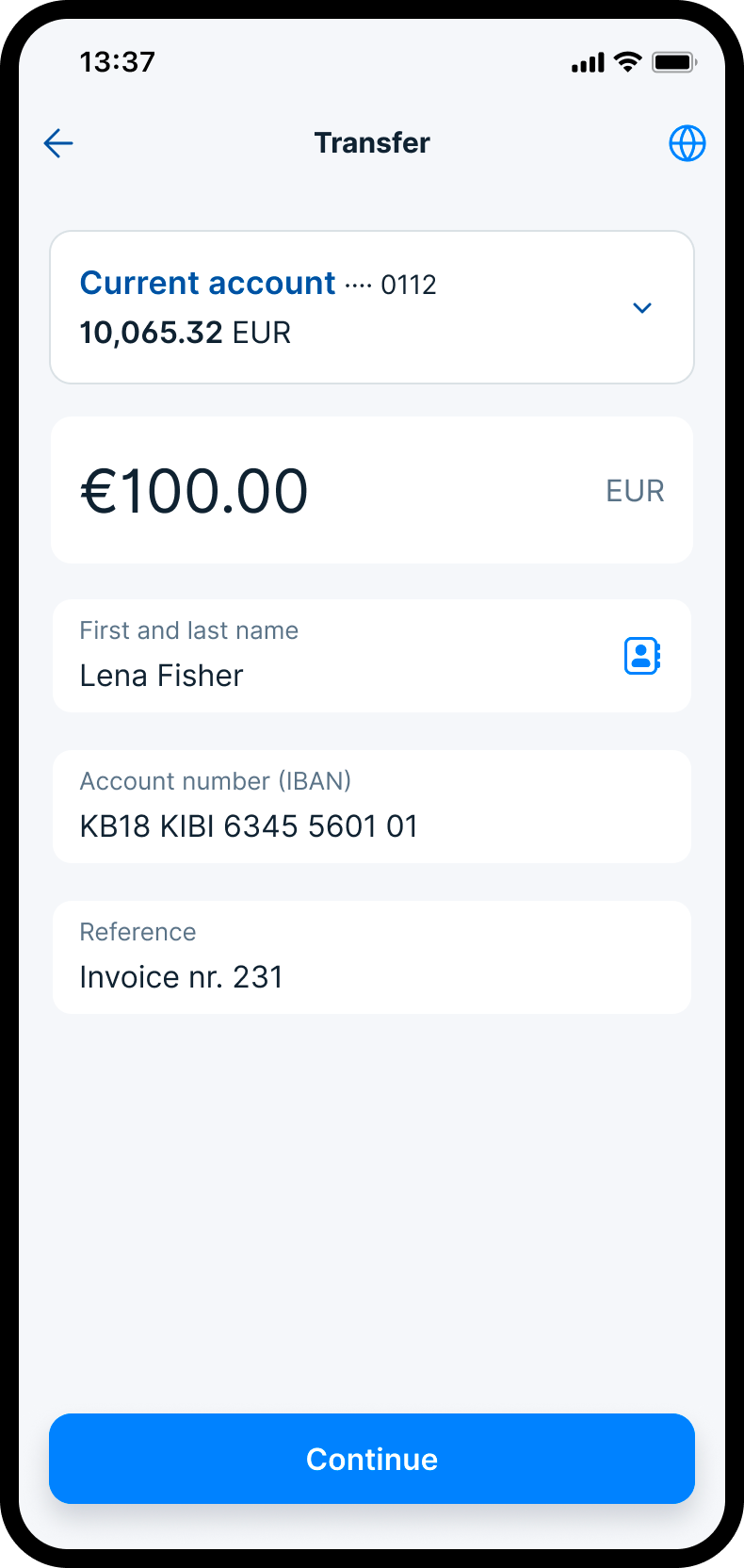

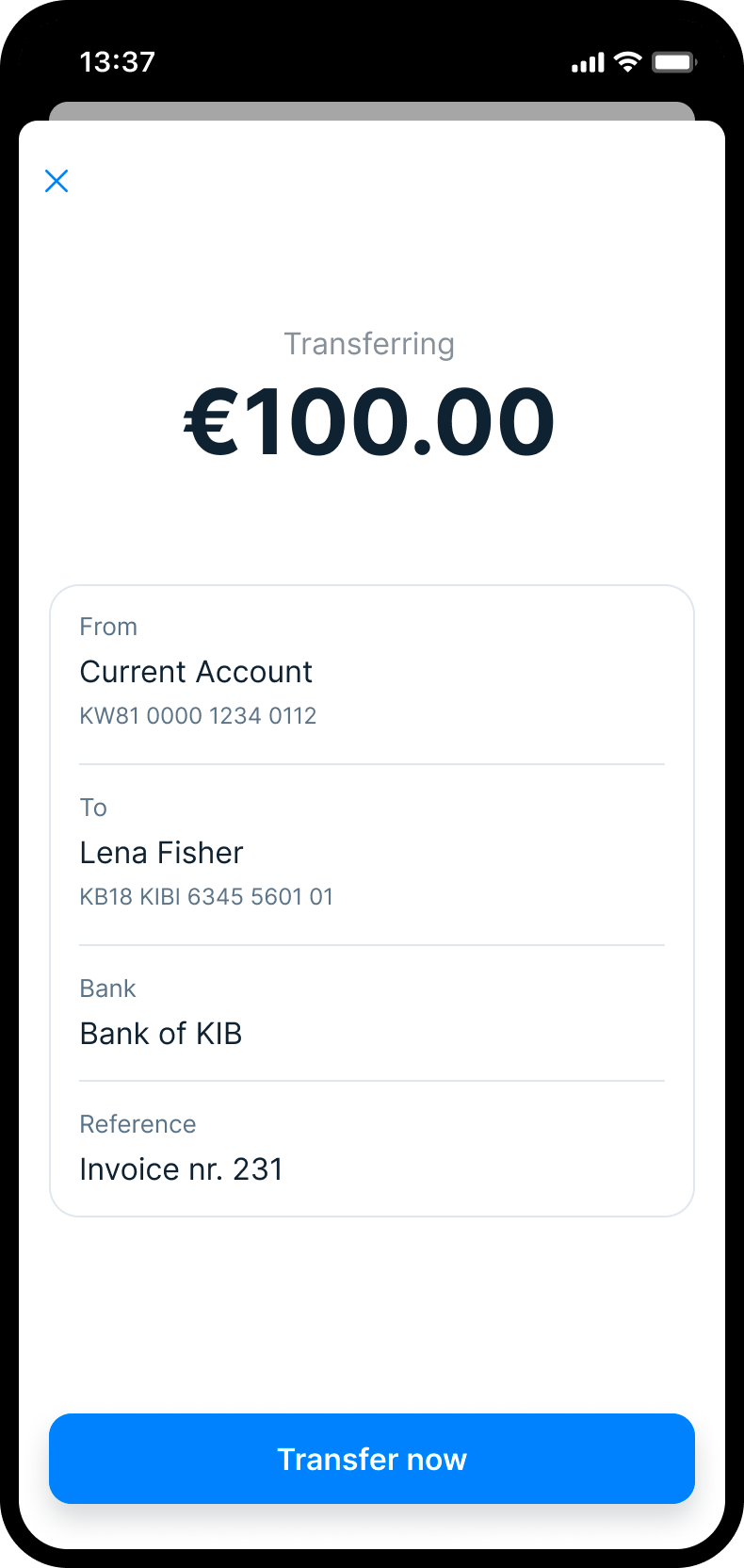

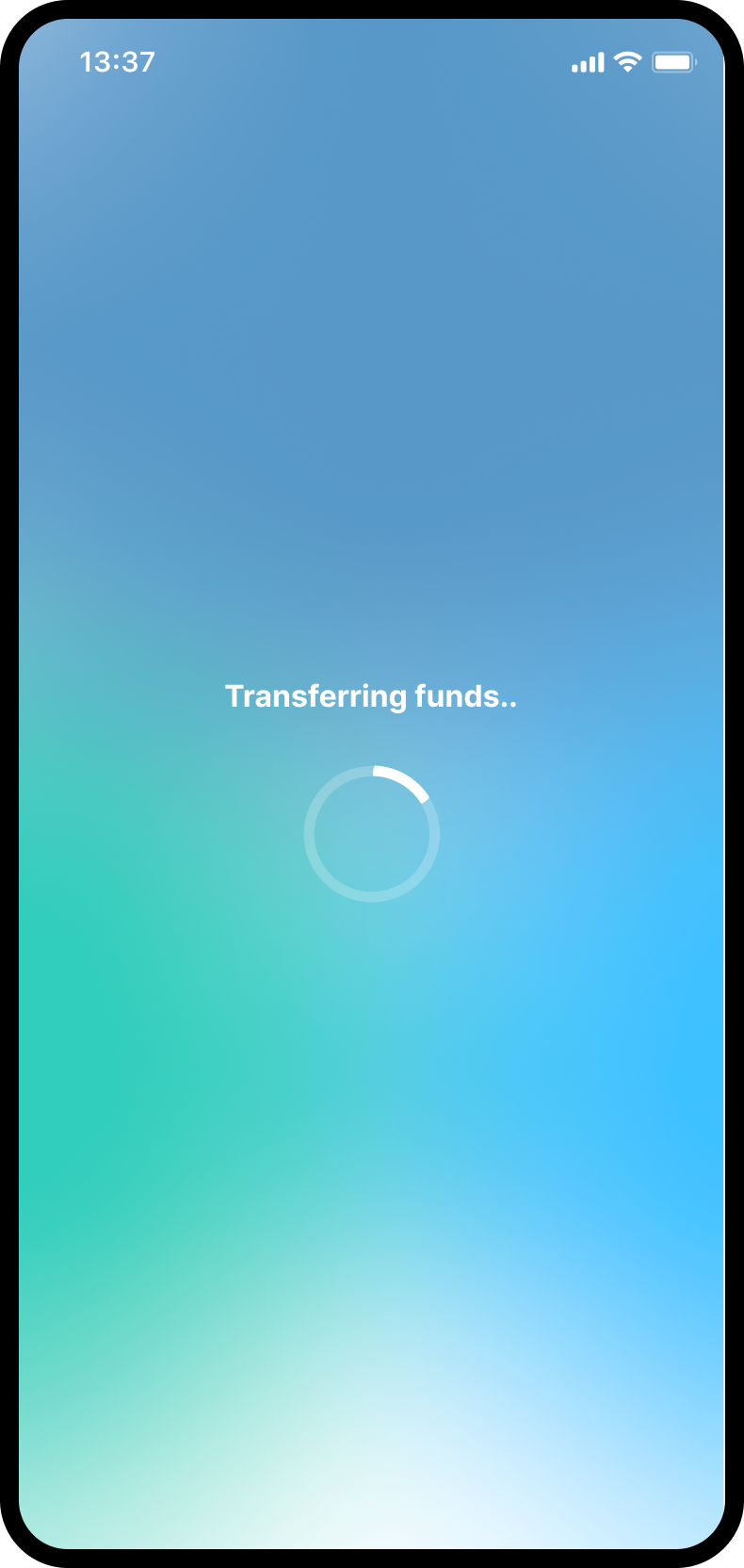

Domestic payments

Domestic payments formed the baseline for the new system. This flow defined the interaction pattern users would learn once and reuse: selecting a source account, entering an amount, identifying a recipient, and reviewing the transaction before confirmation. The design emphasises clarity and progression, ensuring users always understand where their money is going before committing.

Transfer UI

Account selection

Form completed

Review

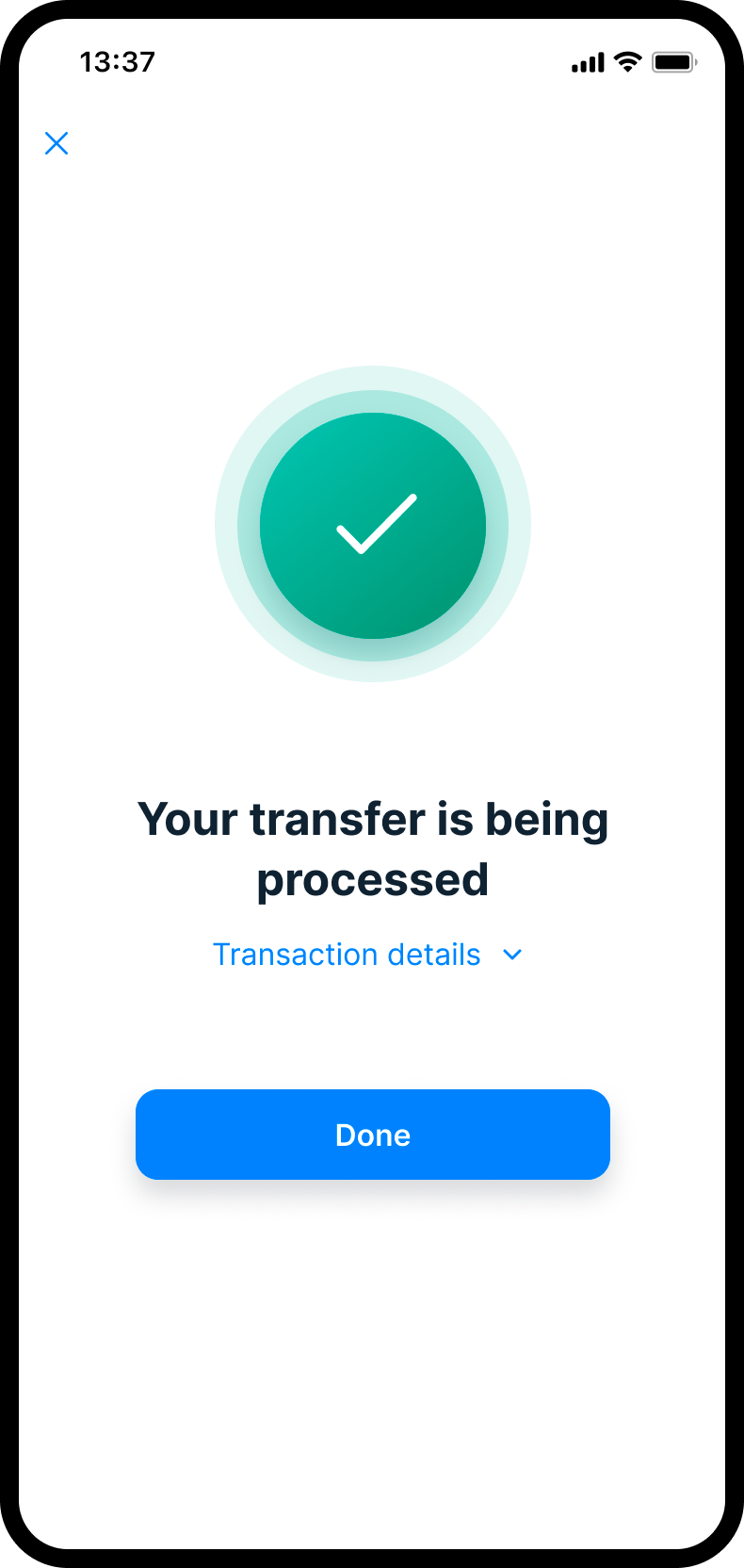

Processing

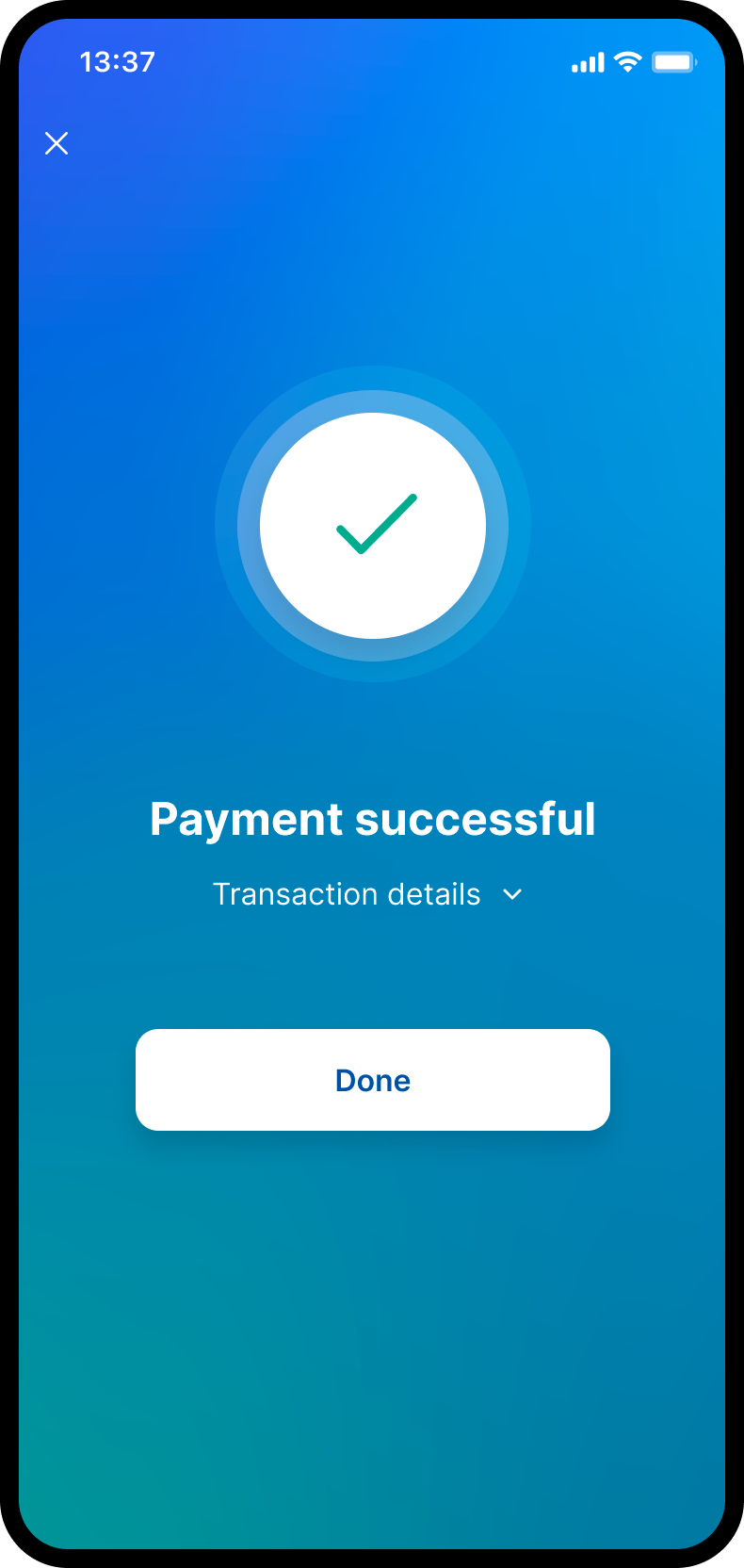

Success

FEATURE

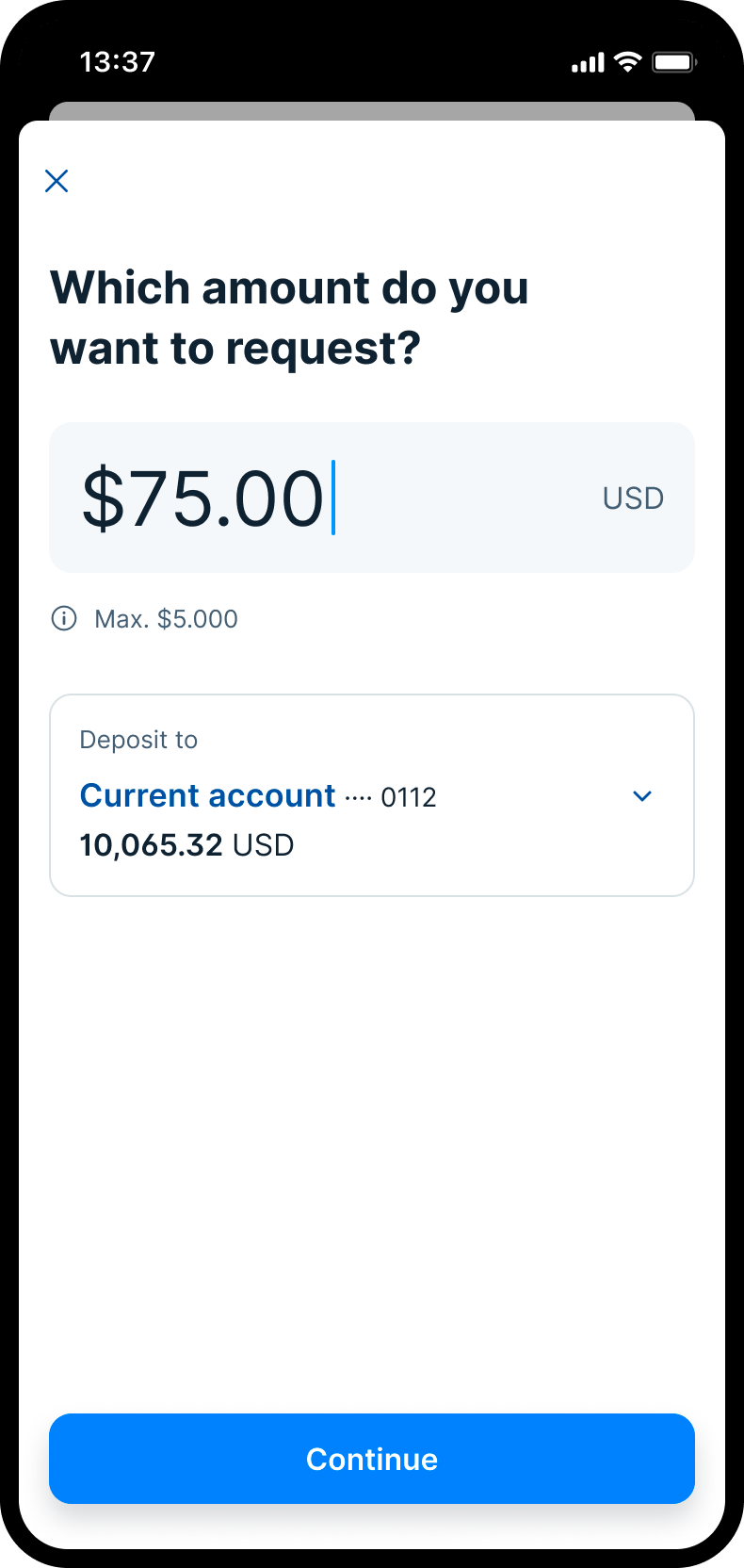

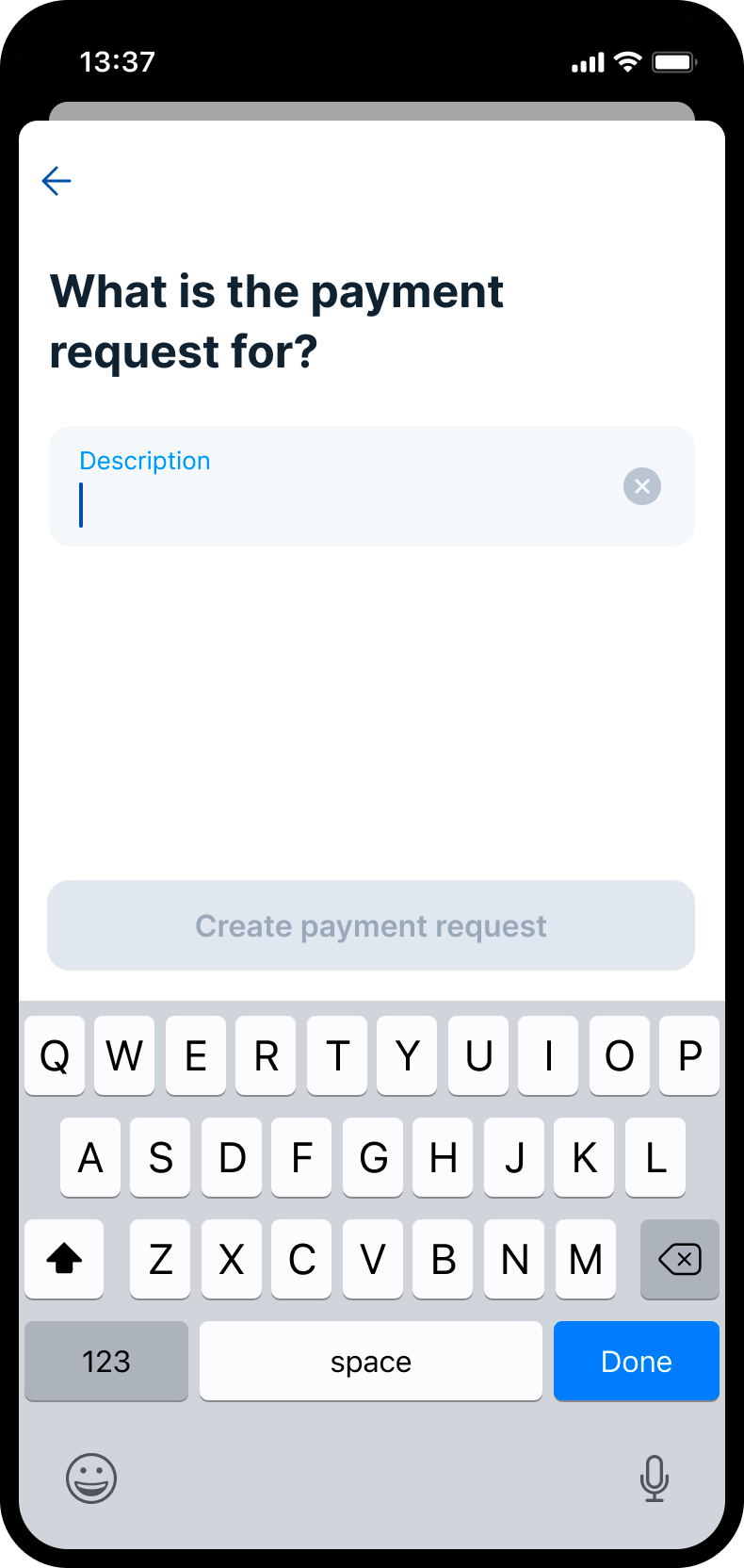

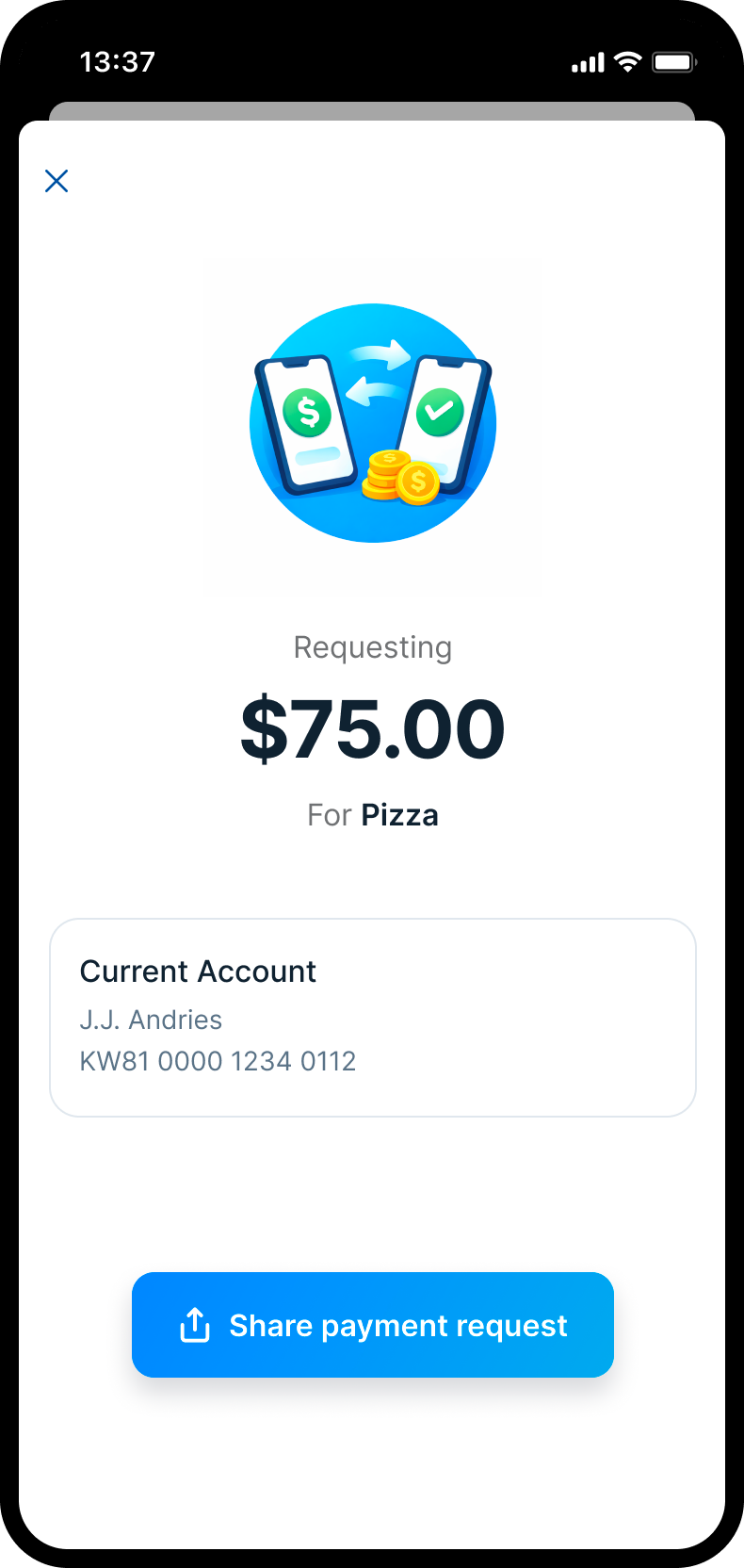

Payment requests

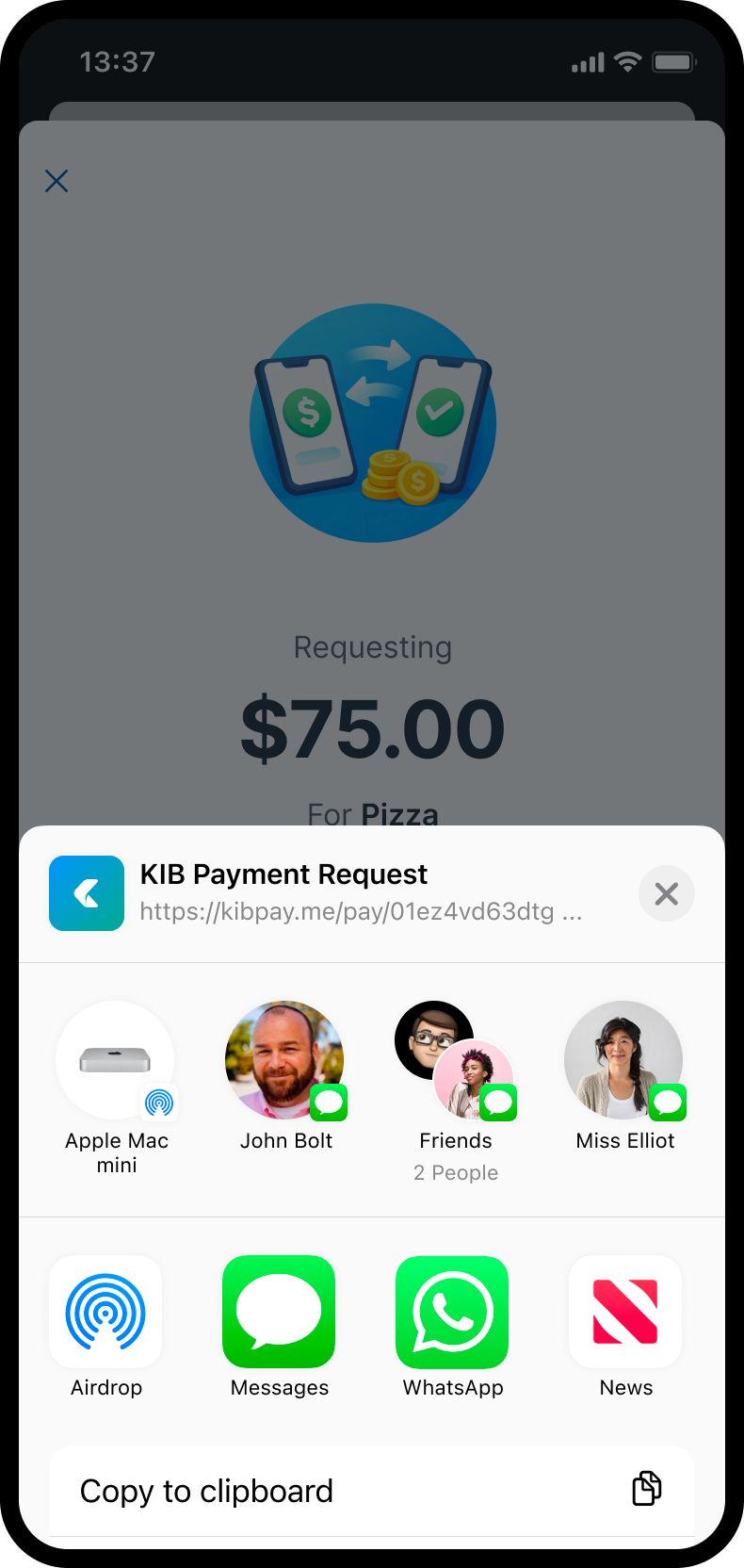

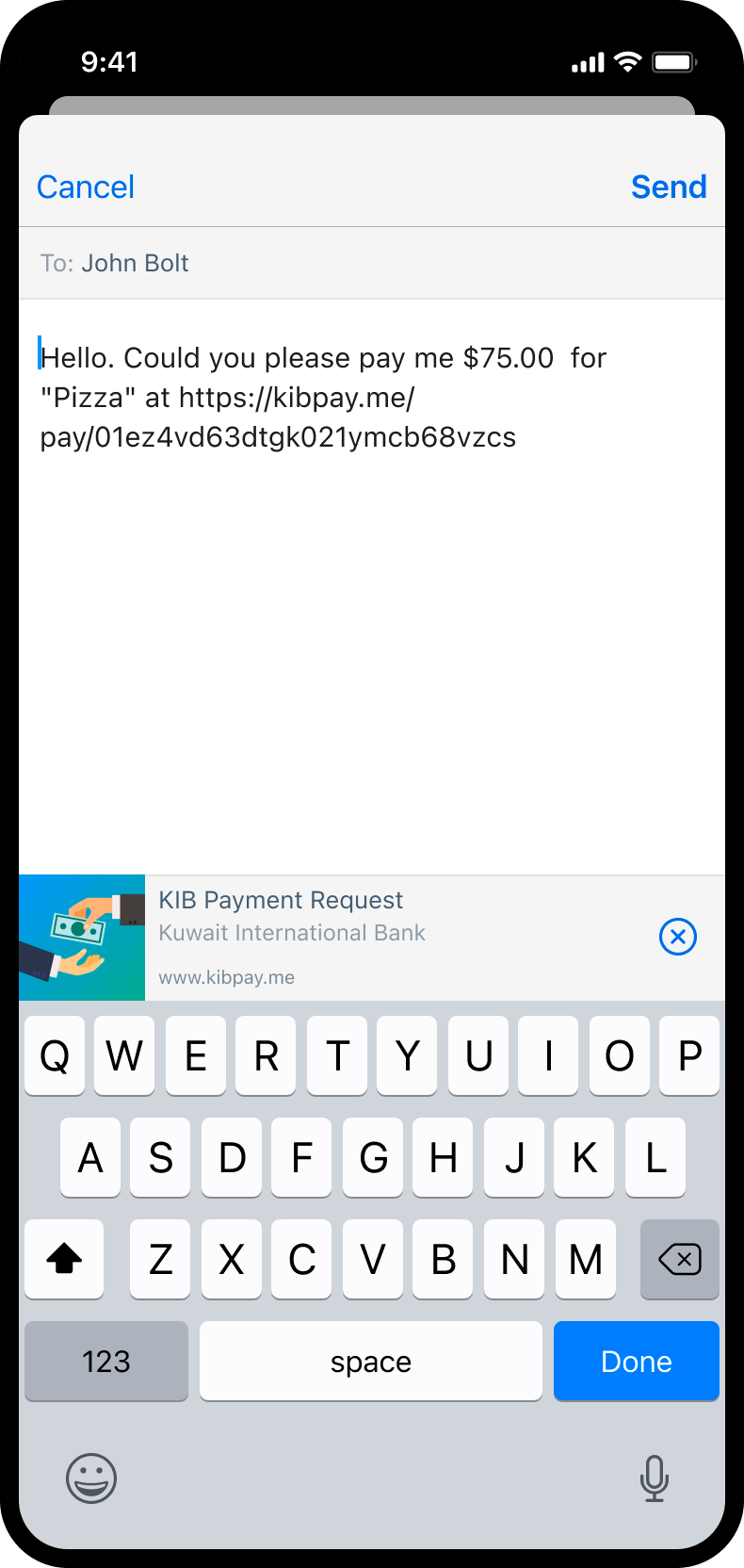

I designed a lightweight payment request flow that lets users set an amount, add context, and share a request through familiar messaging channels without entering a complex banking process. It connects everyday social interactions with the reliability of a bank-backed transaction, introducing a more peer-to-peer way of moving money in a geographical reality where this banking behaviour was still emerging.

Payment request UI

Description

Created + Share

Share modal

Share as message

HIGH COMMITMENT FLOWS

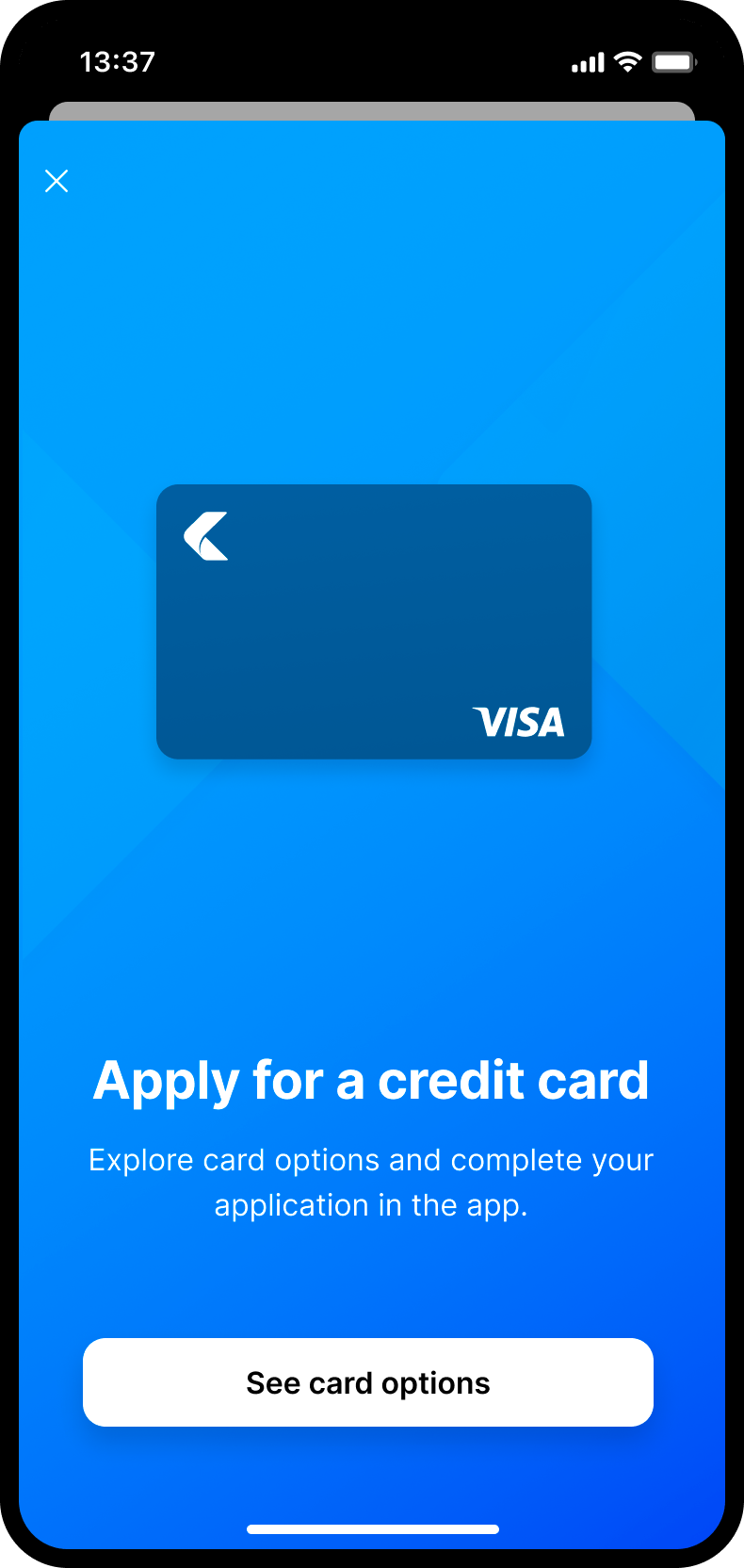

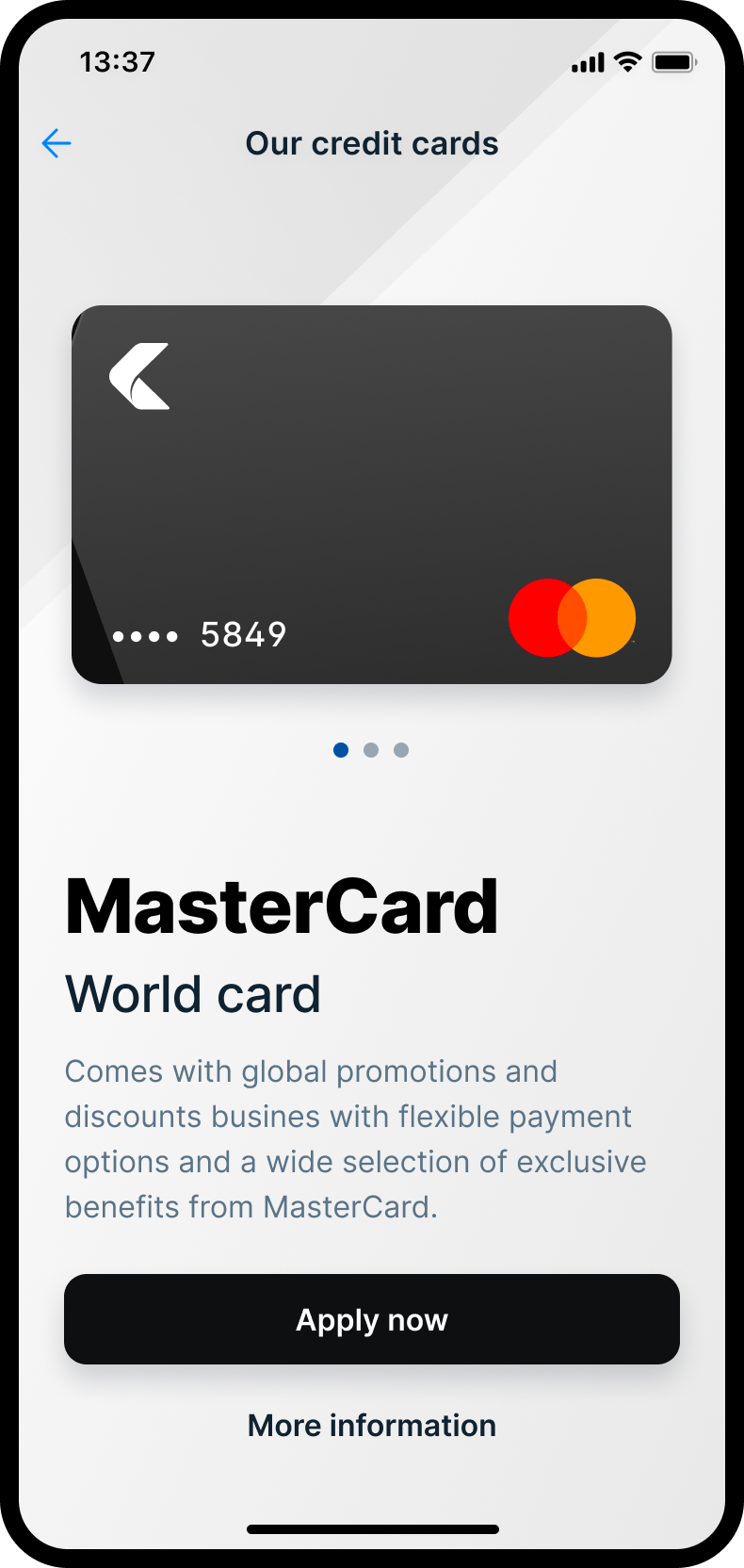

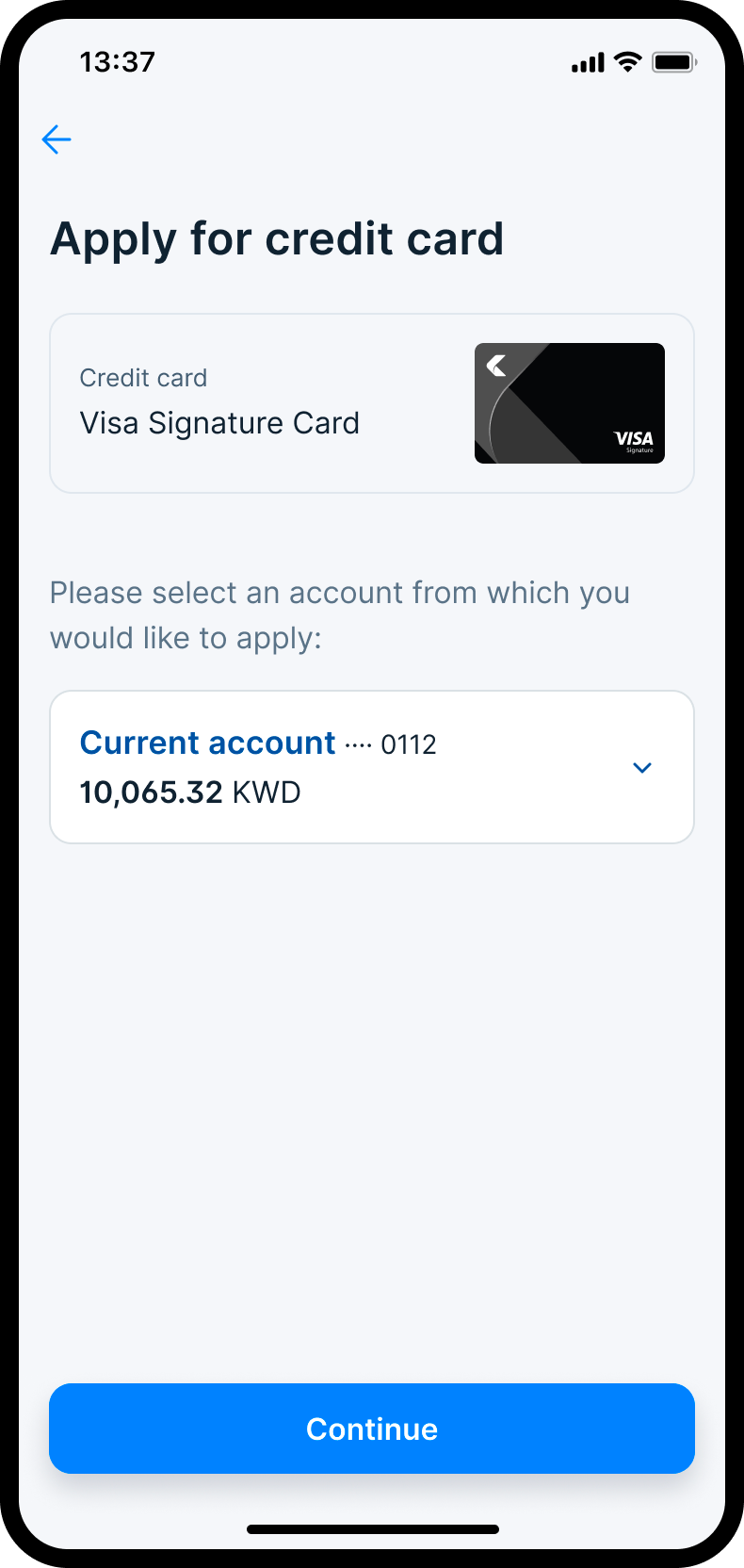

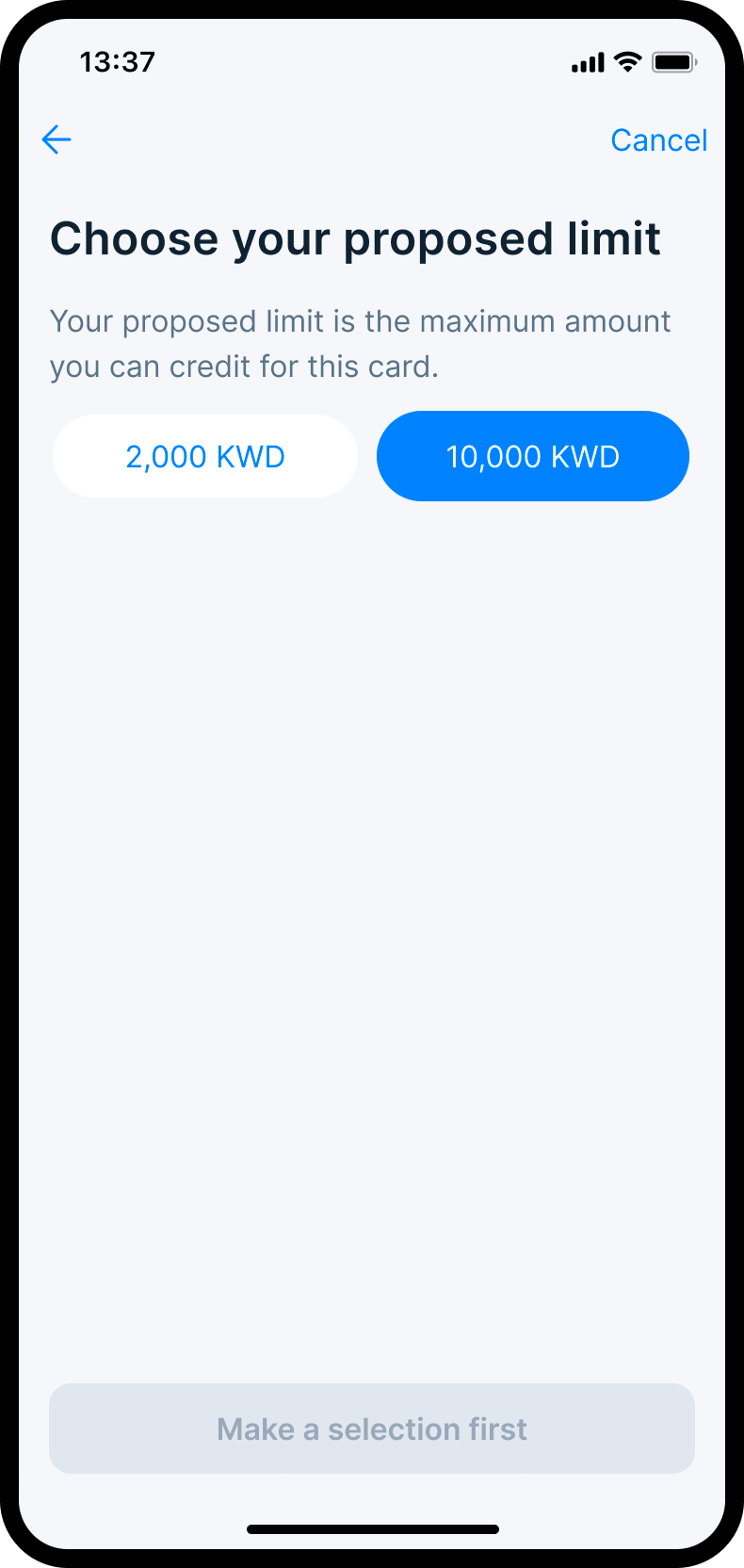

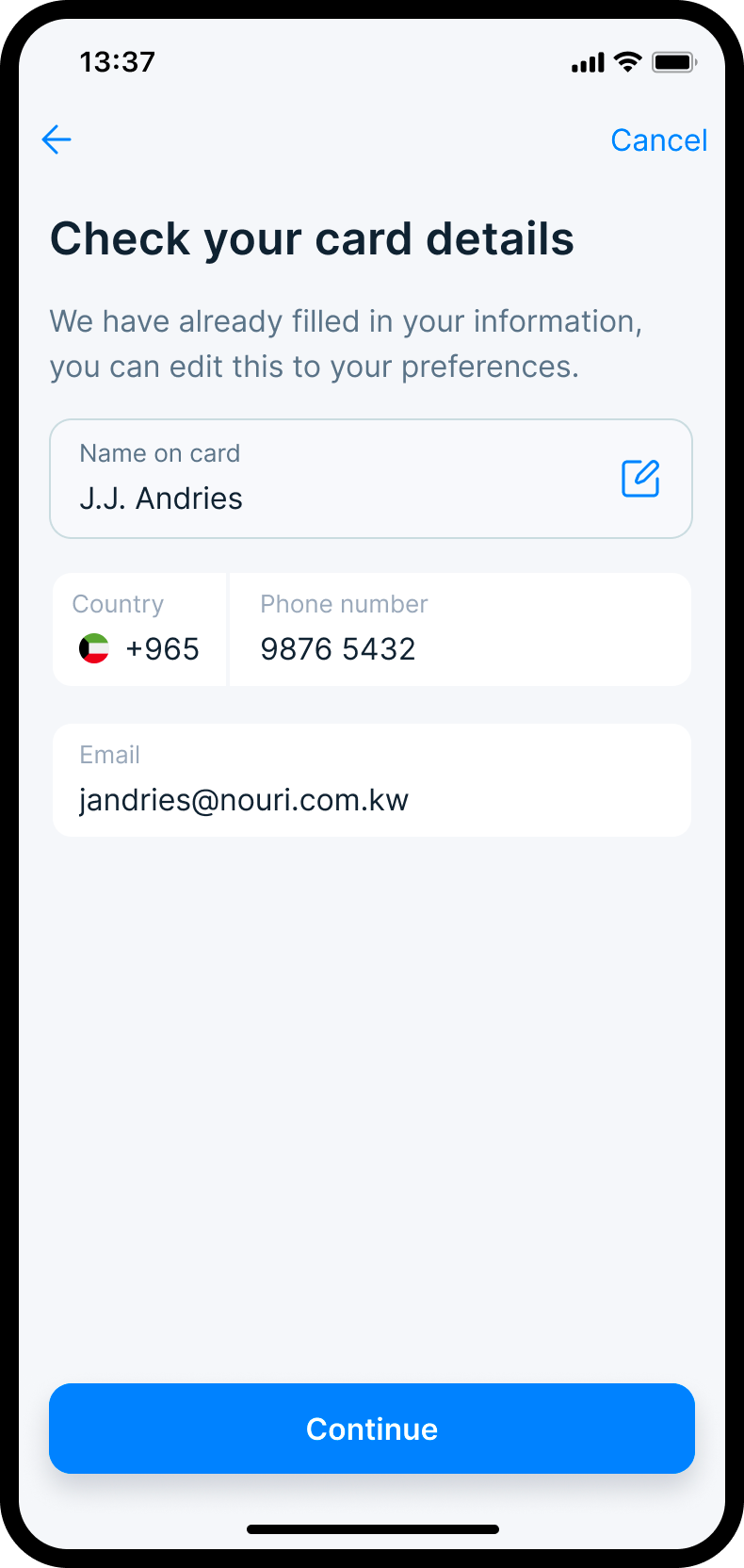

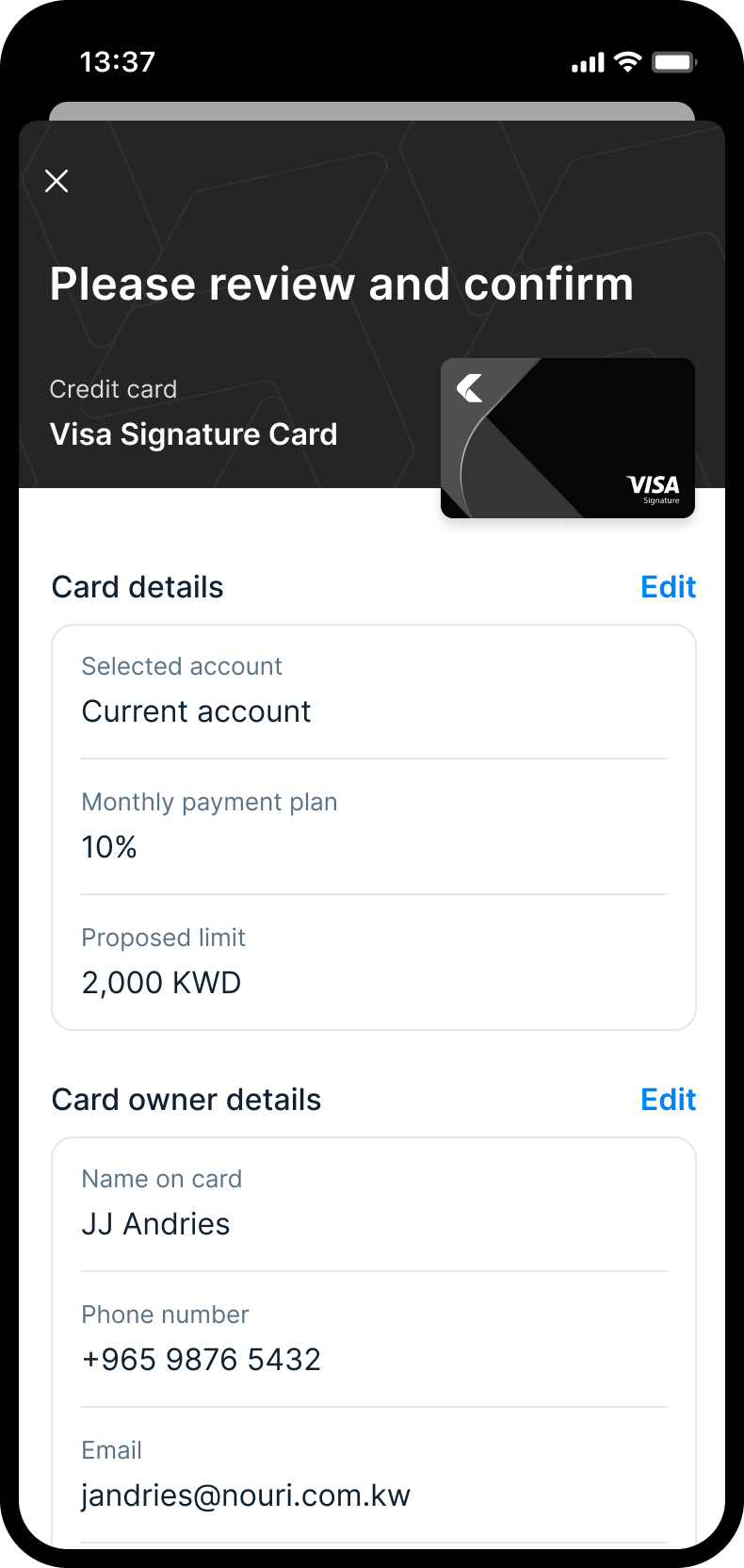

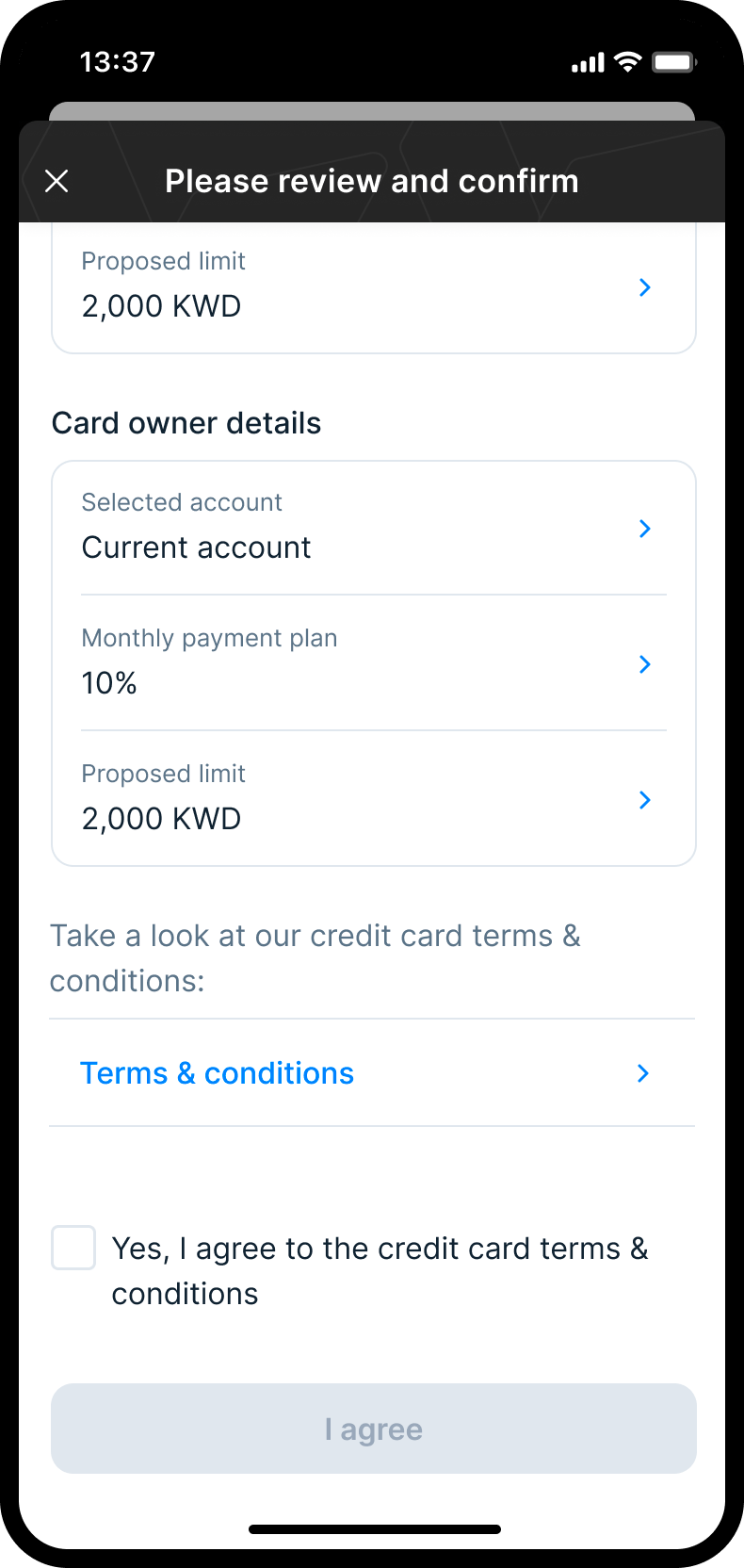

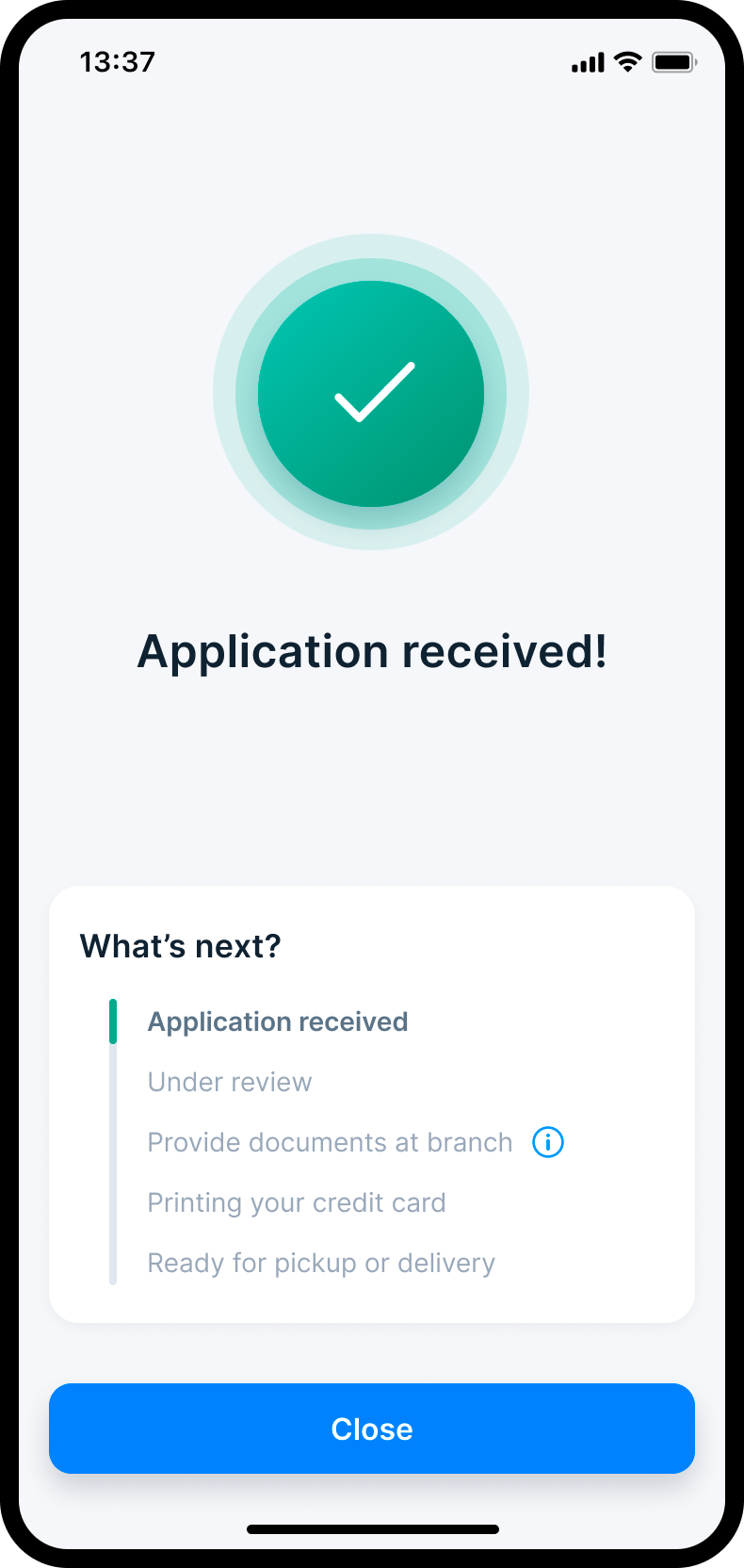

Applying for and managing credit cards

Applying for a credit card is a high-commitment action that can easily feel complex and uncertain on mobile. I designed an end-to-end experience that guides users from card exploration to submission through a clear, structured sequence, balancing product information, financial choices, and required personal details without overwhelming them. Editable review steps, transparent limit and payment selections, and a deliberate confirmation stage help users stay in control, understand what they are agreeing to, and complete the process with confidence.

SCALING THE INTERACTION MODEL

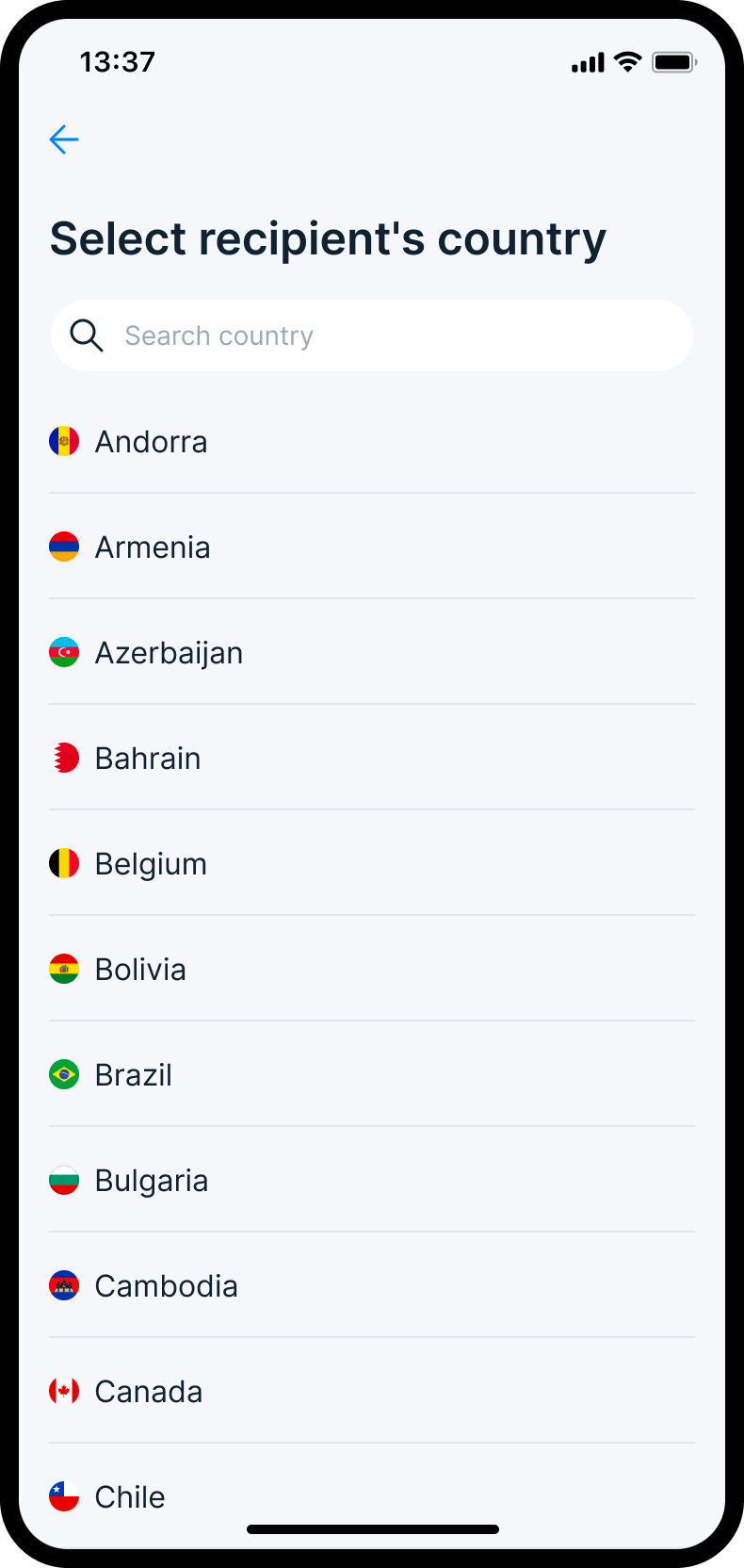

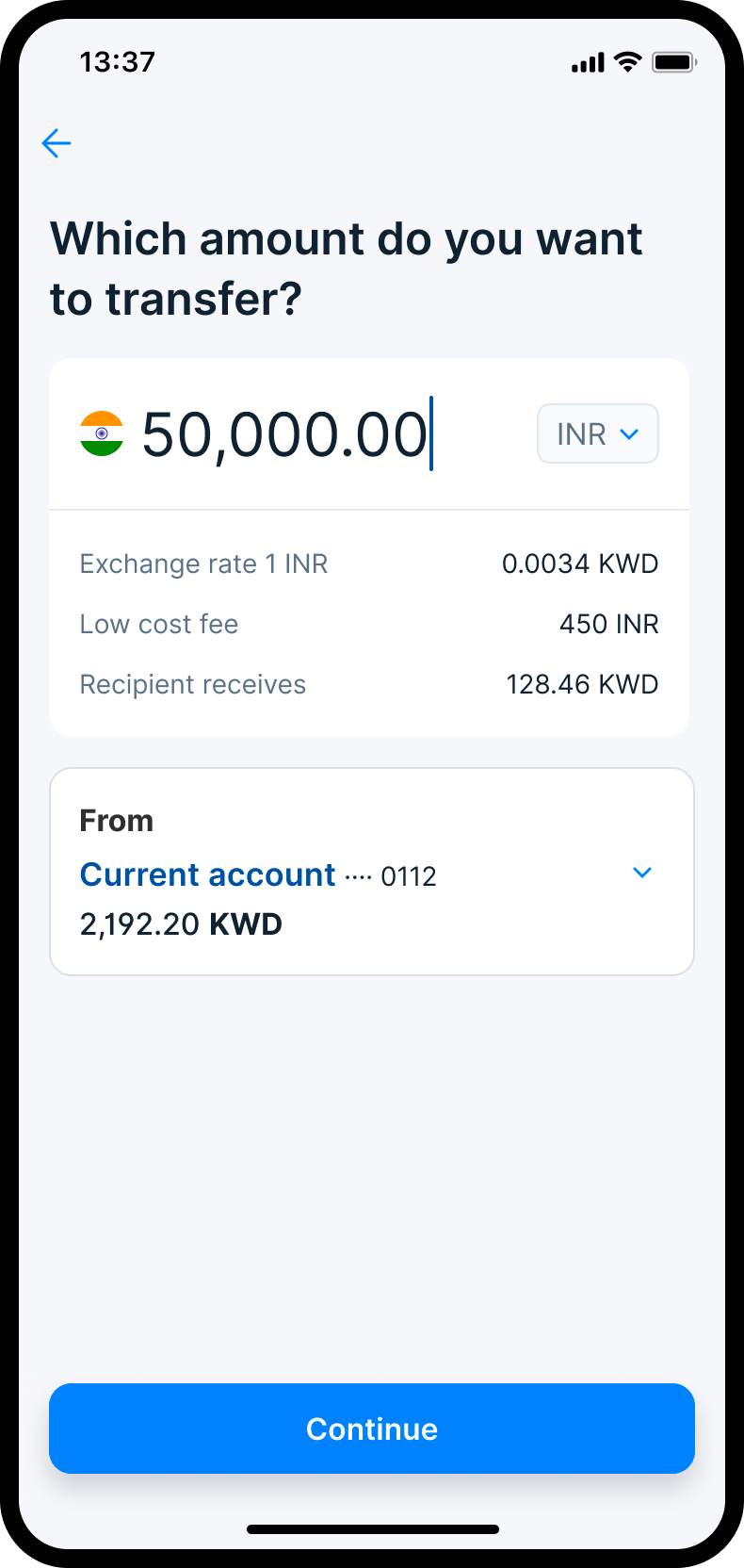

International payments

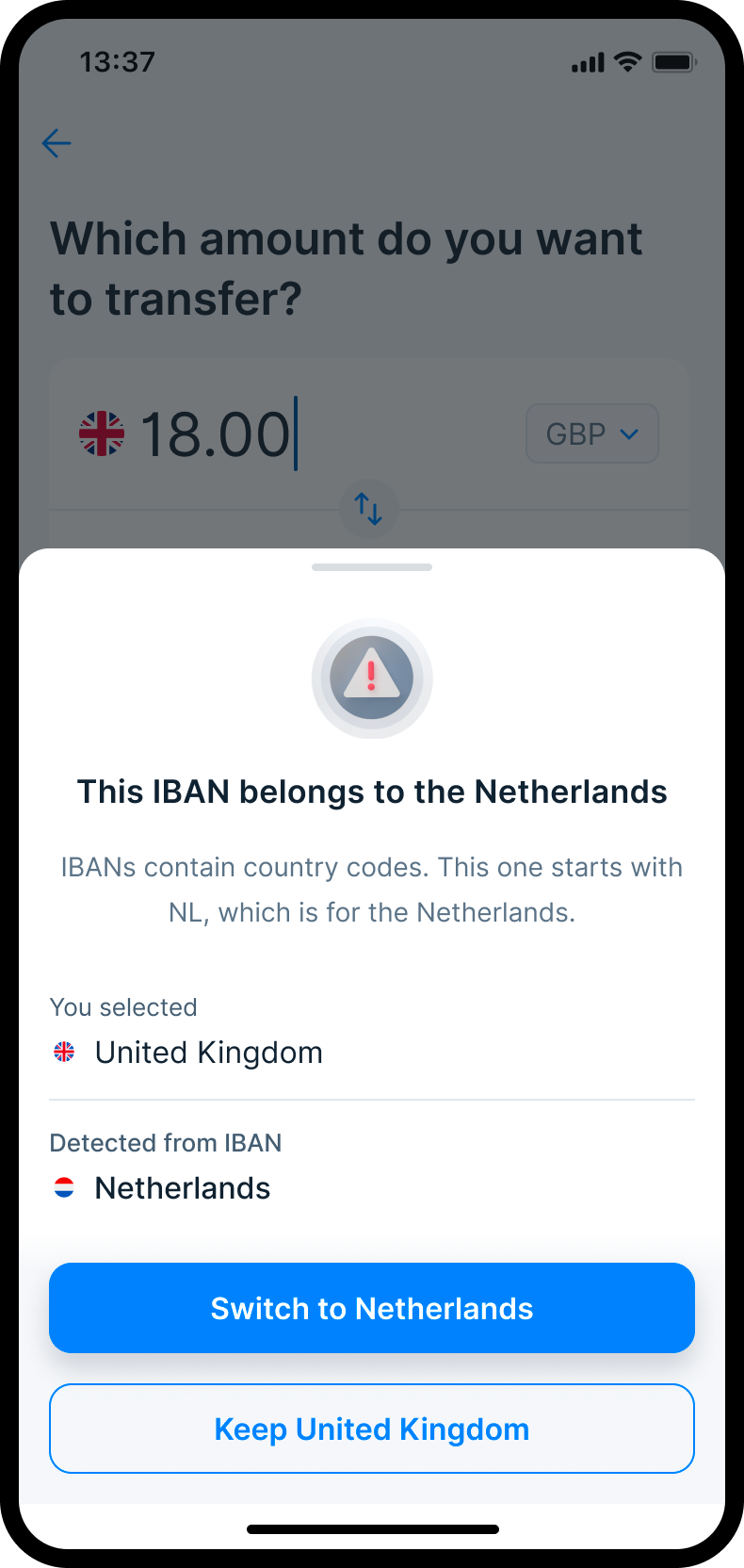

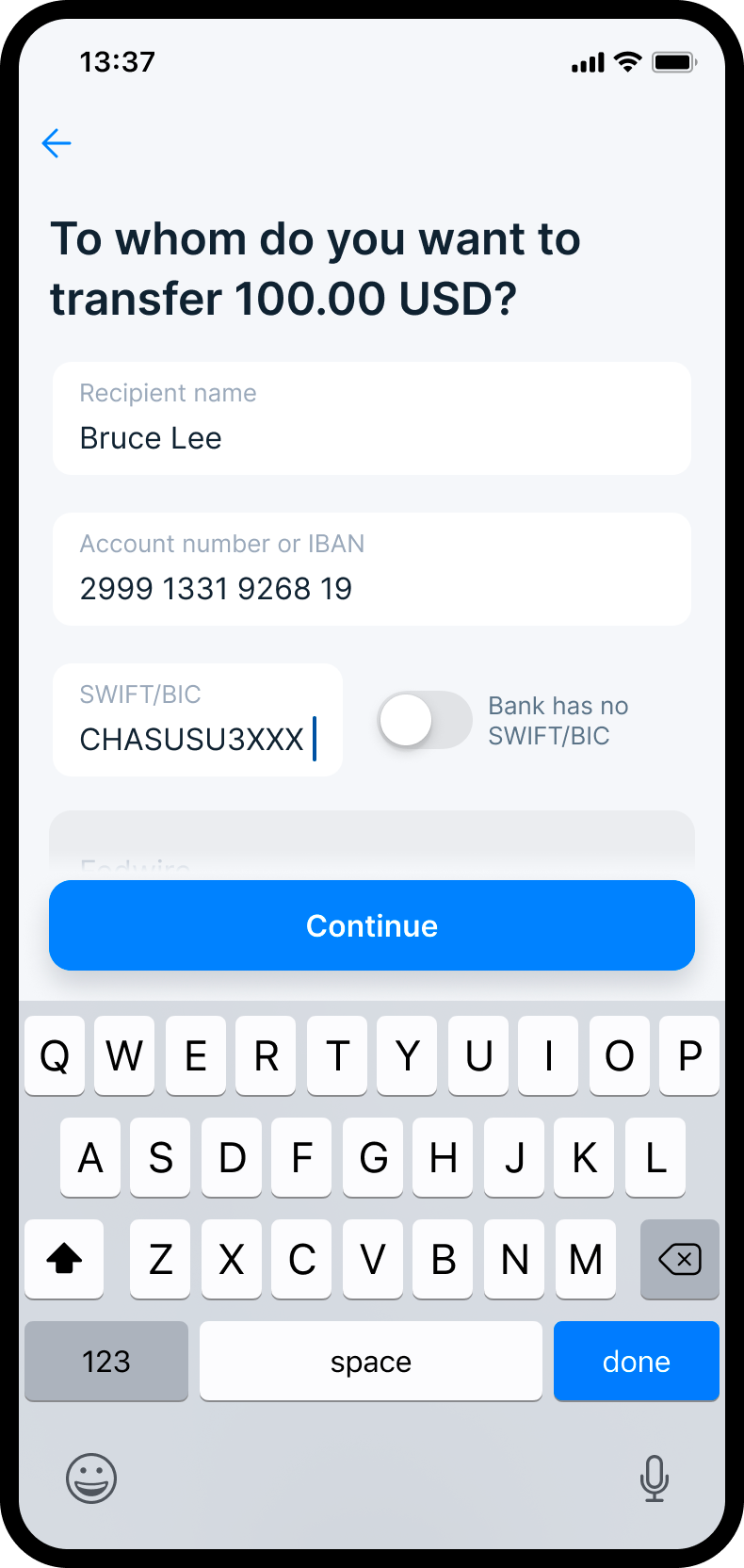

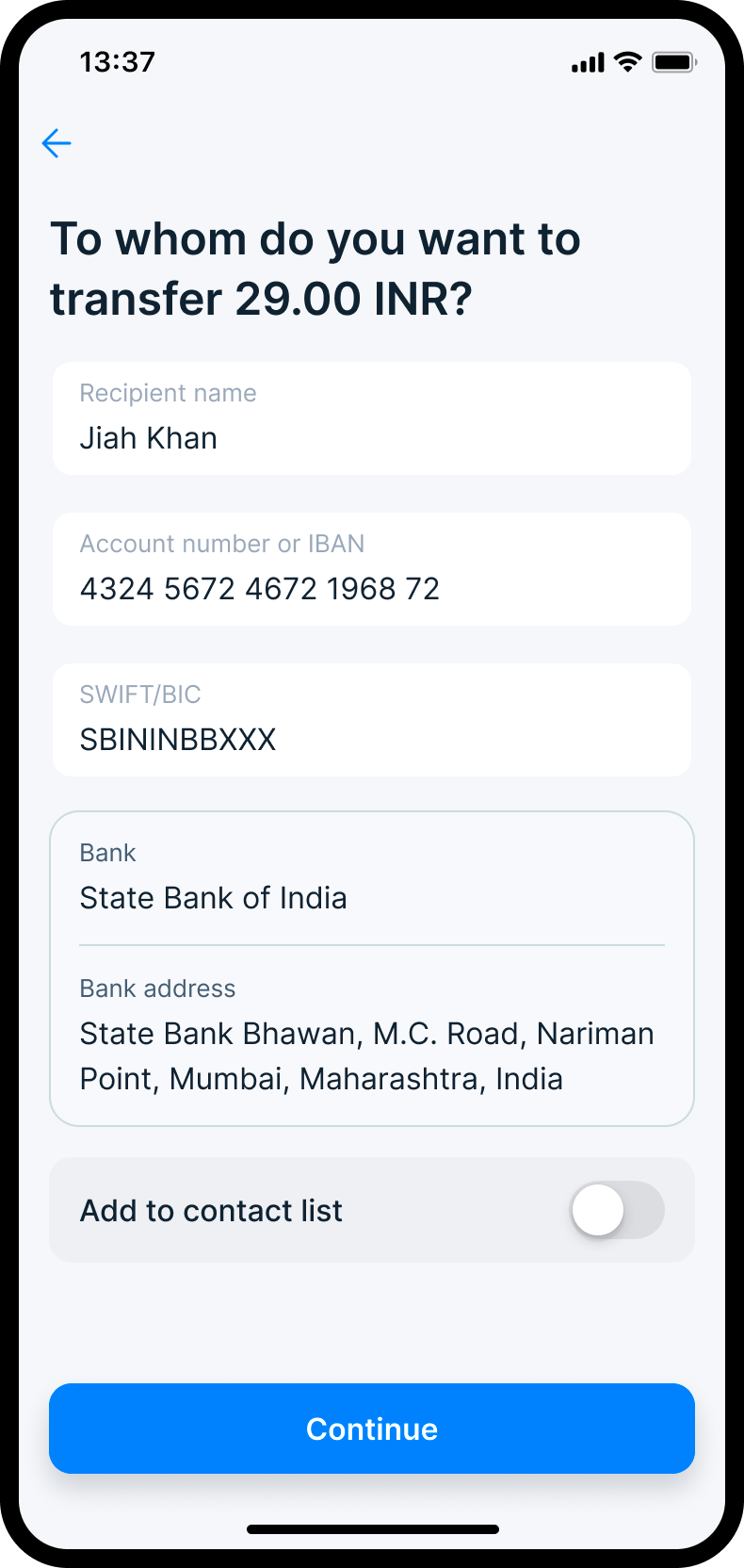

International transfers introduce additional uncertainty such as currency conversion, fees, and country-specific banking requirements. Instead of creating a separate “international” entry point, the existing transfer model was extended to absorb this complexity.

Exchange rates, fees, and recipient amounts are made visible, while additional country-specific compliance and banking fields appear only when required. The experience scales in complexity when the situation demands it, but the interaction remains familiar and consistent.

Recipient country

Amount & conversion (India flow)

IBAN discrepancy

Case: USA

Case: India